Simple Trading Rules

How to select stocks , How to use the trend , How to identify setups with the lowest risk and highest potential (stocks selection), How to enter a trade correctly and set the correct stop loss...

👉🏻If you like and find valuable my work, please let me know about it, hit the like button and share the post. Thank you!

👉🏻For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @V1stocks

👉🏻And if you have any questions or feedback, feel free to shoot me an email at: curicheruvi123@gmail.com or just leave a comment.

This will be a long post, in this post I want to go through my trading rules again. In this post I will write about:

1. How to select stocks

2. How to use the trend

3. How to identify setups with the lowest risk and highest potential (stocks selection)

4. How to enter a trade correctly and set the correct stop loss

5. How to manage position

6. Examples (screenshots)

1. How to select stocks

My main program for charts is tc2000, I am currently using 3 screening formulas👇

ADR ( average daily range % ) >2,7%

Volume ( Dollars 5-day ) >70k

Volume ( 14- Day ) >130k

these 3 parameters give out an average of 1500 stocks, every weekend I go through these 1500 tickers.

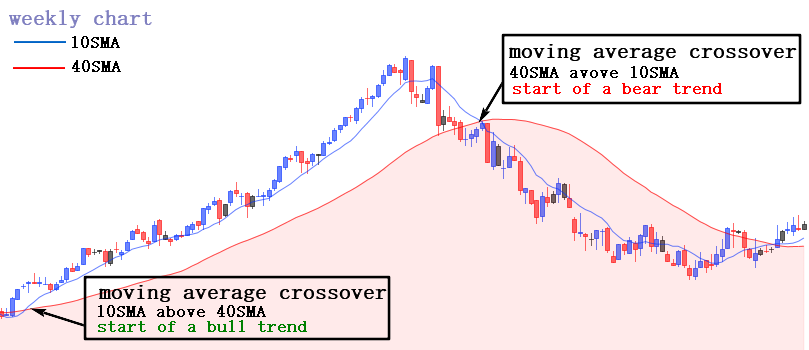

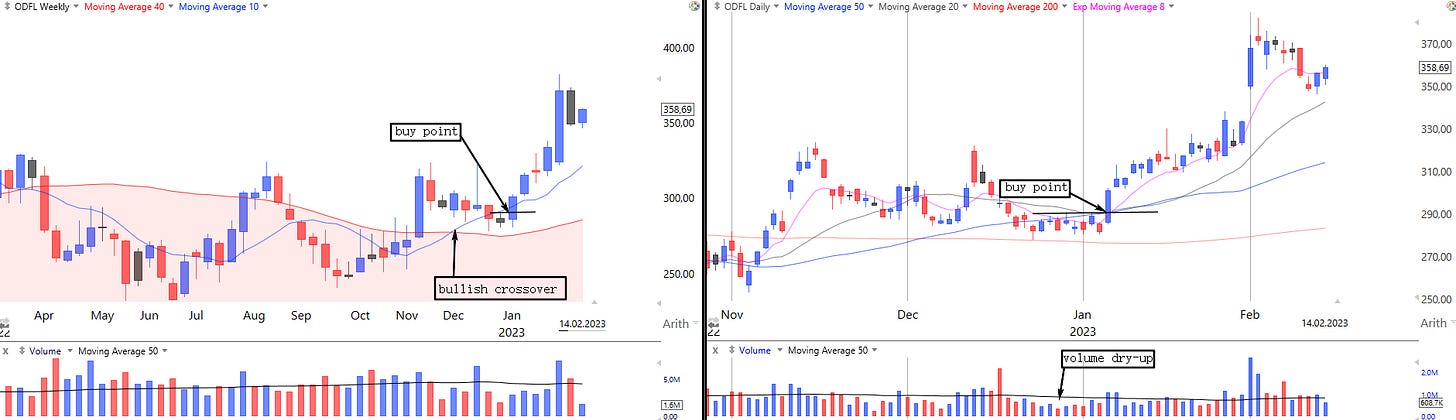

2. How to use the trend

I have a basic rule for determining the trend, these are the moving averages on the weekly chart 10 simple moving average and 40 simple moving average. I never go long stocks that are in a bearish trend and short stocks that are in a bullish trend. Below in the screenshot you will see how I determine the trend👇

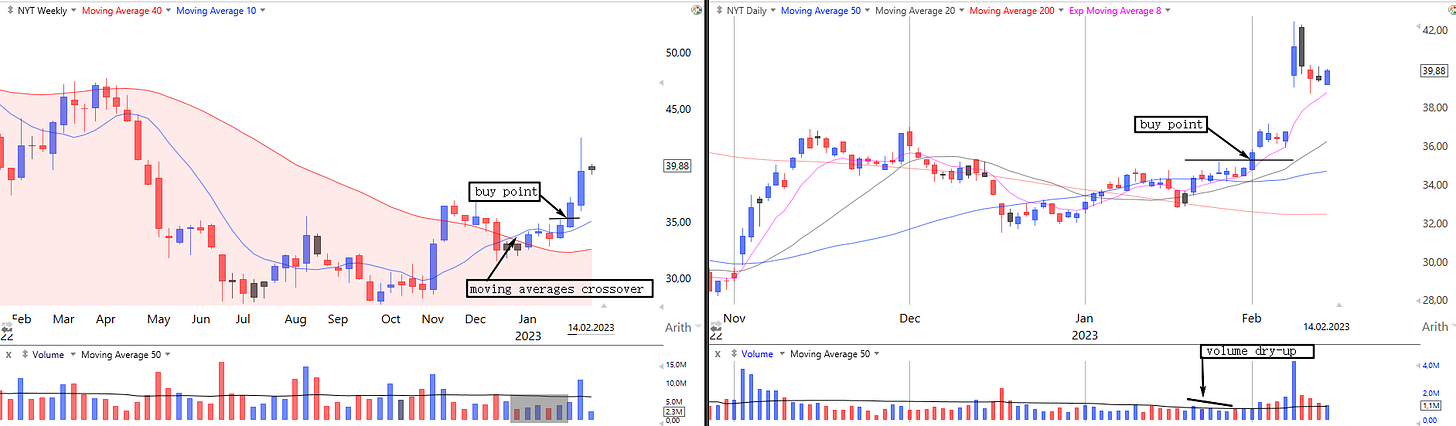

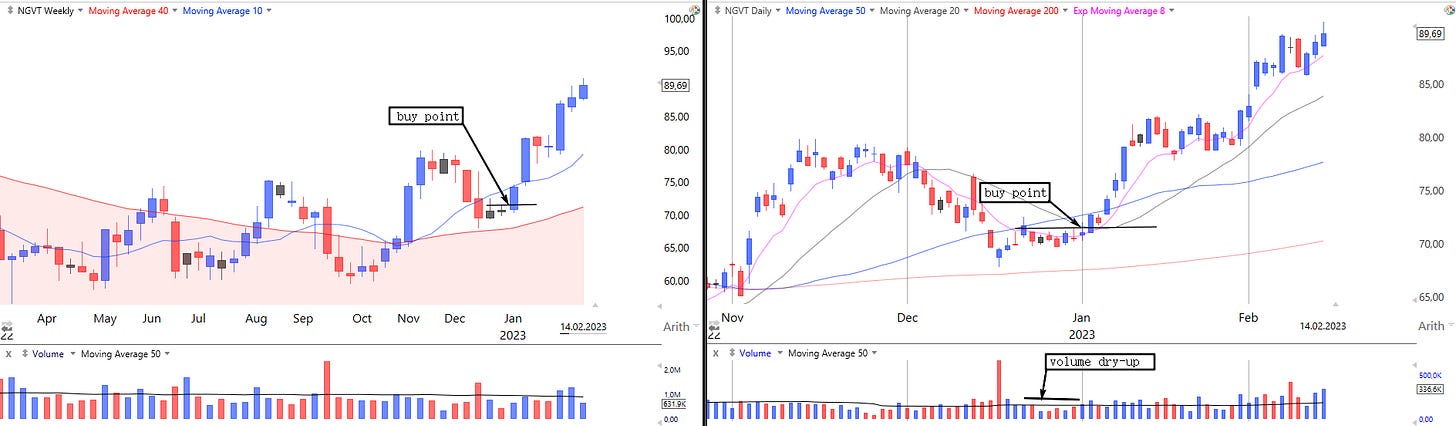

3. How to identify setups with the lowest risk and highest potential (stocks selections)

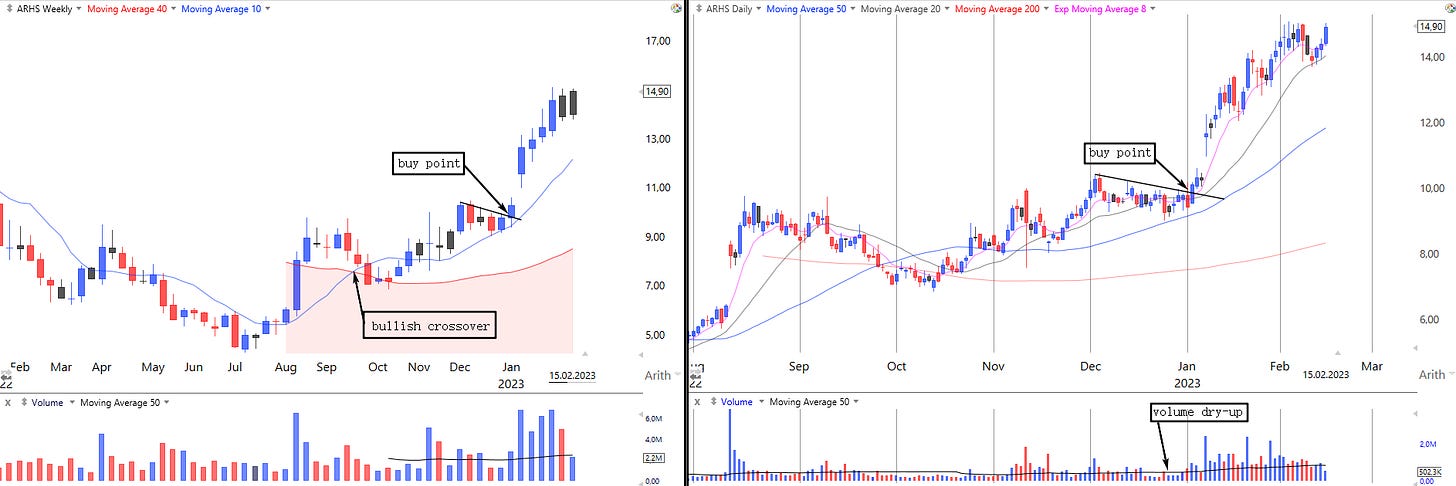

And here the advantages of using a weekly chart are best revealed. I only select stocks on the weekly chart. Here I pay attention to several parameters:

price should be as close to 10SMA as possible

volume behavior, usually before a large price movement, the average traded volume falls, this can be clearly seen on the daily chart.

weekly bars: inside bar, bullish and bearish engulfing, pin bar, hammer, I mainly focus on weekly bars with a small price range.

Setup example👇

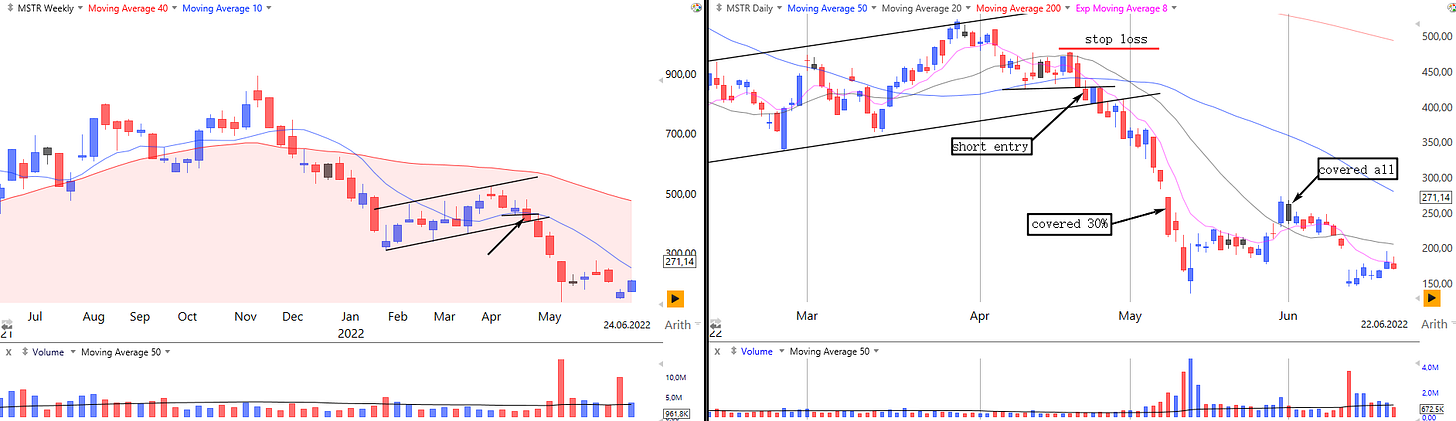

4. How to enter a trade correctly and set the correct stop loss

A good trade starts with a small but correct risk. I always enter a trade when the price breaks the previous high or low of the weekly bar. Usually stop loss is placed behind the low of the previous weekly bar if it is long position, or the high of the previous weekly bar if it is short position. But there is only one exception, when the stop loss is placed behind the low or high of the current weekly.

example👇

5. How to manage position

I manage my positions simply when the risk/reward ratio reaches 1/3, I cover 30% of my position. The rest I cover when the price closes 2 consecutive days in a row under 20SMA, if it is a long position, and 2 consecutive days over 20SMA if it is a short position.

example👇

this post sums up dozens of books read and tens of thousands of charts viewed!

If this post helped you, please share it on your twitter,THANKS!🙏

6. Examples (screenshots)

You can see many more examples in my previous posts. But you can independently look at all these setups in history,this will help you a lot.